Imagine ensuring your family business thrives for generations, no matter what the future holds. That's…

Strategic Planning for Personal and Health Care Decisions: The Importance of Personal Directives

As a Chartered Professional Accountant with a Trust and Estate Practitioner (TEP) designation, an LL.M in Tax Law, and an LL.B, my expertise extends beyond traditional financial advising. At Shajani CPA, we recognize the critical importance of comprehensive life planning, including the preparation of personal directives. This legal instrument is a cornerstone in safeguarding your personal, health care, and financial preferences in times of incapacity.

Understanding Personal Directives

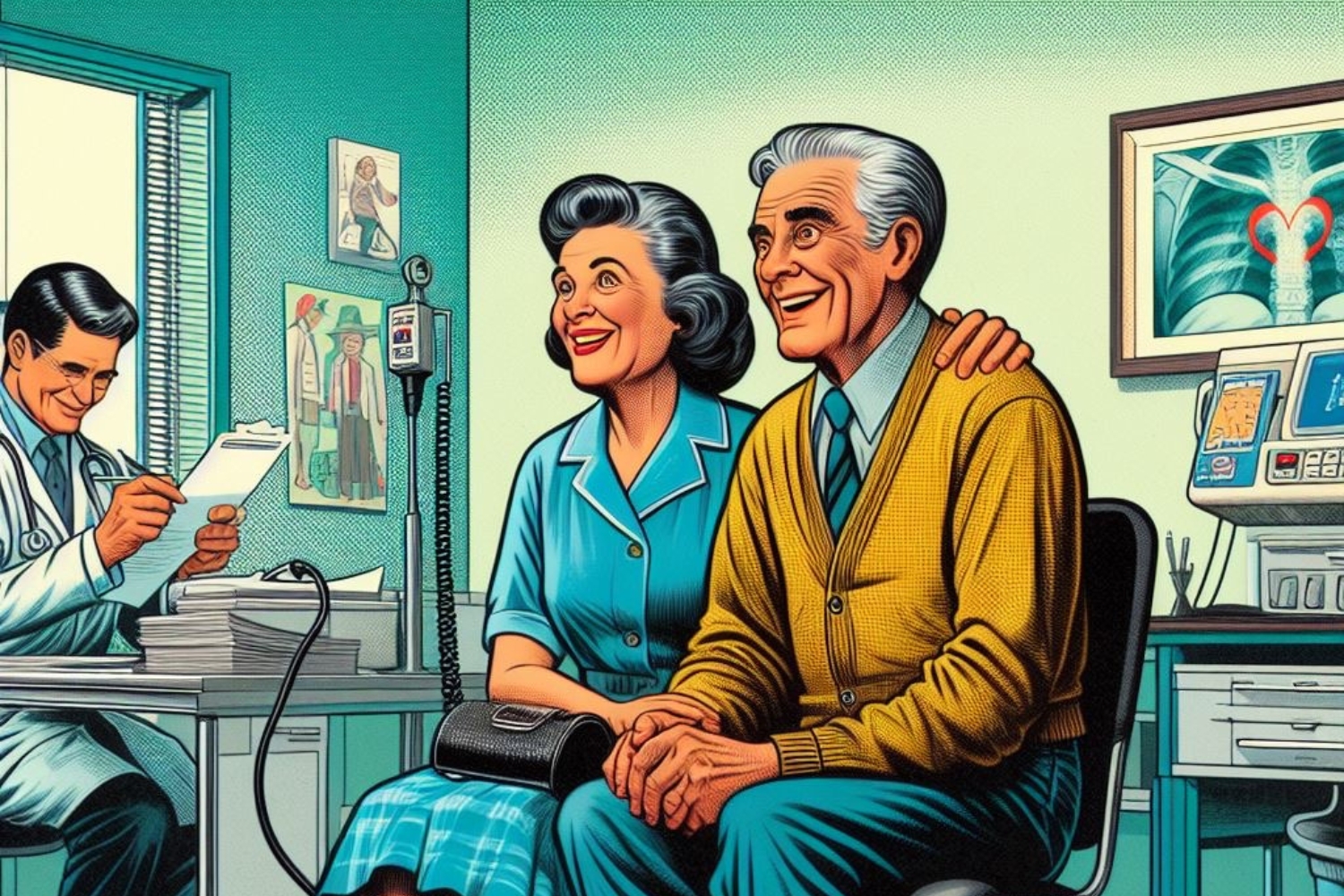

A personal directive, commonly referred to as a living will, is a legal document that anticipates situations where an individual may become incapacitated and unable to make key decisions. This directive outlines specific instructions for health care, personal care, and sometimes financial affairs, ensuring that one’s wishes are honored.

Key Aspects of a Personal Directive:

- Appointment of an Agent: You can designate a trusted individual, whether a family member, friend, or advisor, as your agent or proxy to make decisions on your behalf when you are incapable.

- Scope of Decision-Making: The document can encompass various aspects, including medical treatments, housing preferences, and end-of-life care.

- Expression of Personal Wishes: It allows the articulation of specific desires, such as a no heroic measures clause or advance instructions in cases of mental incapacity.

- Enforceability Conditions: The directive becomes enforceable only when you are deemed incapable of making these decisions independently.

Legal Requirements and Enforcement

Creating a valid and enforceable personal directive requires adherence to specific legal standards. This includes ensuring the directive meets the criteria of being a valid legal document, confirming the maker’s incapacity at the time of enforcement, and ensuring that the care provided aligns with the directive’s instructions.

Given that personal directives are recognized in most Canadian provinces and territories, each with its unique legal framework, it is crucial to seek professional legal advice to ensure compliance and accurate reflection of your wishes.

Why Choose Shajani CPA for Personal Directive Planning?

At Shajani CPA, our multidisciplinary expertise positions us uniquely to guide you through the intricacies of personal directive planning. Here’s how we stand out:

Holistic Approach: Our background in tax law, estate planning, and legal aspects allows us to provide comprehensive advice, considering all facets of your life planning.

Personalized Guidance: We understand that each individual’s situation is unique. We tailor our services to reflect your specific needs and preferences.

Ensuring Legal Compliance: With our deep understanding of the legal requirements across different jurisdictions, we ensure that your personal directive is both valid and enforceable by utilizing an external law firm.

Peace of Mind: Knowing that your future is planned in line with your wishes provides immeasurable peace of mind, both for you and your loved ones.

Conclusion: Safeguard Your Future with Shajani CPA

In life’s unpredictable journey, preparing a personal directive is a step towards ensuring that your personal and health care decisions are respected and executed as per your wishes. At Shajani CPA, we are dedicated to assisting you in creating a directive that speaks your voice, even when you might not be able to do so yourself.

Connect with us at Shajani CPA, where we blend legal expertise with compassionate advising to prepare personal directives that secure your future and reflect your wishes.

This information is for discussion purposes only and should not be considered professional advice. There is no guarantee or warrant of information on this site and it should be noted that rules and laws change regularly. You should consult a professional before considering implementing or taking any action based on information on this site. Call our team for a consultation before taking any action. ©2024 Shajani CPA.

Shajani CPA is a CPA Calgary, Edmonton and Red Deer firm and provides Accountant, Bookkeeping, Tax Advice and Tax Planning services.