Passing a family business from one generation to the next is a proud milestone, but…

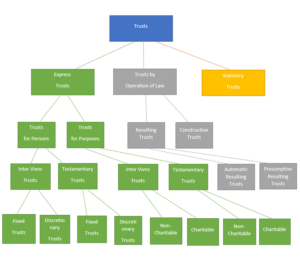

Classification of Trusts

A trust allows you to separate control and management of assets from its owners. This separation allows for distinct advantages that will result from the details contained within the trust deed. There are several types of trusts and legal scholars have attempted to make sense of all the thousands of cases on trusts by grouping or classifying them. The below is a high-level summary borrowed from STEP and is just one method of classification to allow us to understand the types of trusts that may be right for your circumstance.

An express trust is one that is intended to be created by a person. This expression may be evidenced by a trust deed and could be for the benefit or persons or for a particular purpose. For example, persons may benefit if the trust is set up by a grandparent for their grandchildren to fund their education. Alternatively, a trust may be for the purpose of encouraging good teaching and be set up to fund a reward to encourage teaching excellence at a particular school. And either of these may be set up during creator (settlor) of the trust’s lifetime (inter vivos) or after the pass away via their will (testamentary).

The trust will be administered by a trustee. The trust can be discretionary, allowing the trustee more leeway to make decisions, or it can be fixed in which case the terms of the trust are more stringent and must be followed.

Each of these trusts may also be for charitable purposes or non-charitable purposes.

A trust by operation of law may result where there was no express intention to create a trust. This resulting trust may occur where there was an implied intention to create a trust. In some cases, the resulting trust may be automatic, such as the case where the income from the trust is to be allocated to the settlor’s child during their lifetime with all capital to go to the settlor’s grandchildren who are yet to be born. If the child dies without any children of their own, there may be an automatic resulting trust for the child’s estate.

Presumptions are made in a presumptive trust. Such a situation may occur if Sam gave Shaq a large sum of money and Shaq uses those funds to purchase land in his own name. It could be argued that the funds provided to Shaq were not a gift and that Shaq holds the property in trust for Sam. This would be a presumptive trust that could result from an operation of law.

Where there is no express trust or trust that is implied resulting from an operation of law, the operation of the law could result in a constructive trust. One example this situation may occur is when a trustee sells trust property to a corporation owned by himself for fair market value and that same property doubles in value some years after the sale. A court may rule the corporation was held in trust for the original beneficiaries. This would be a trust by operation of the law that is not implied, or a constructive trust.

Different methods for classifying trusts include how the trust was crated, the object of the trust, determining if the trust is settled during the settlors’ lifetime or after, the amount of discretion of the trustee (if any) and if the trust is for charitable or non-charitable purposes. These considerations are further broken down into types of trust classifications. Some of these include the following:

Trusts are versatile financial instruments used for estate planning, asset protection, and charitable purposes. Here’s a breakdown of the top 10 types of trusts, each serving unique functions and purposes:

- Public Trusts: These are established for the benefit of the public at large. A common example is a charitable trust, which is created to support charitable activities and is often eligible for tax benefits.

- Private Trusts: Designed to benefit specific and ascertainable individuals or groups. These trusts are commonly used for family estate planning, ensuring that assets are distributed according to the grantor’s wishes.

- Executed Trusts: In these trusts, all terms are clearly defined and set out. The trustee has no need for further instructions to manage the trust assets, as the directions are comprehensively laid out.

- Executory Trusts: These trusts identify the beneficiaries but leave details on how the benefits will be shared undefined. Further instructions or actions are required to fully realize the trust’s terms.

- Completely Constituted Trusts: Here, three essential certainties are met: the intention to create a trust is clear, the trust property is well-defined, and the beneficiaries or objectives are clearly identified. Moreover, the property is already in the trustee’s hands.

- Incompletely Constituted Trusts: These trusts also meet the three certainties (clear intention, defined property, and clear objectives), but the critical difference is that the trust property is not yet in the trustee’s possession.

- Bare Trusts: In a bare trust, the trustee’s role is minimal. They are only required to transfer the property to the beneficiaries when demanded. The trustee does not have active management or decision-making responsibilities regarding the trust assets.

- Protective Trusts: These are designed to protect the beneficiaries, particularly in situations like bankruptcy. The trust ensures that if a beneficiary goes bankrupt, their interest in the trust terminates, safeguarding the trust assets.

- Spendthrift Trusts: Aimed at preventing beneficiaries from mismanaging their interests, these trusts restrict the beneficiary’s ability to transfer or dispose of their interest in the trust. This type is often used to protect the trust assets from creditors or from the beneficiary’s potential financial irresponsibility.

- Discretionary Trusts: Not listed in your original request, but worth mentioning for completeness, these trusts allow trustees to exercise discretion in distributing the trust income or principal among the beneficiaries. This flexibility makes them ideal for situations where beneficiaries’ needs might change over time.

This information is for discussion purposes only and should not be considered professional advice. There is no guarantee or warrant of information on this site and it should be noted that rules and laws change regularly. You should consult a professional before considering implementing or taking any action based on information on this site. Call our team for a consultation before taking any action. ©2023 Shajani CPA.

Shajani CPA is a CPA Calgary, Edmonton and Red Deer firm and provides Accountant, Bookkeeping, Tax Advice and Tax Planning services.