Navigating the complexities of self-employment and business income is crucial for Canadian families managing family-owned…

Bank Reconciliations

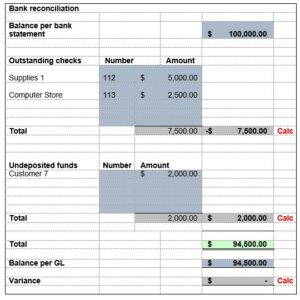

Making financial decisions with accurate information is imperative and understanding your cash balance is fundamental to the decision-making process. Cash is usually the first item on the balance sheet of the financial statements and can be an indicator of the short-term viability of a corporation. However, the accounting cash balance does not always reflect what is on a bank statement. The difference is determined by a reconciliation of the bank and done for each bank account.

Two of the most common adjustments made to the bank include outstanding checks and deposits in transit.

Outstanding checks

Outstanding checks include payments that have been made, most often by a check written as of the financial statement date, however had yet to clear the bank. These amounts must be subtracted from the bank balance in the reconciliation.

This information is for discussion purposes only and should not be considered professional advice. There is no guarantee or warrant of information on this site and it should be noted that rules and laws change regularly. You should consult a professional before considering implementing or taking any action based on information on this site. Call our team for a consultation before taking any action. ©2023 Shajani CPA.

Shajani CPA is a CPA Calgary, Edmonton and Red Deer firm and provides Accountant, Bookkeeping, Tax Advice and Tax Planning services.